Is Gold a better investment than stock market ?

Owning the metal – Before we discuss details about this question let us first understand how can you invest in gold. One of the simplest form which our previous generations have used is buying jewelry. They gift it to their kids on important occasions like marriage. I call it ‘passing on the metal’ or ‘inheriting the metal’. It is like retaining the asset and passing it on to generations and not en-cashing it till it is really an emergency. Some of the generations may have already used it up for their business or needs at home while others may have held it in their safes and bank lockers.

Commodity investment – Those who have been in investment may use the commodities market to invest in metals like Gold. This gives them an opportunity to buy and sell the lots of gold without physically possessing the metal and protecting it in safes.

Gold Funds – Another form of investment in gold is buying ‘Gold Funds or ETFs’. The famous ones known are :

- GLD (SPDR Gold Shares)

- IAU (iShares Gold Trust )

- SGOL (ETF Physical Swiss Gold)

- DGL (PowerShares DB Gold ETF)

- VGPMX (Vanguard precious Metals and Mining Shares)

Basically investors use these ETFs or other metal ETFs to spread their portfolio and diversify it. But the question is if Gold is the right investment and can be used to safeguard risk.

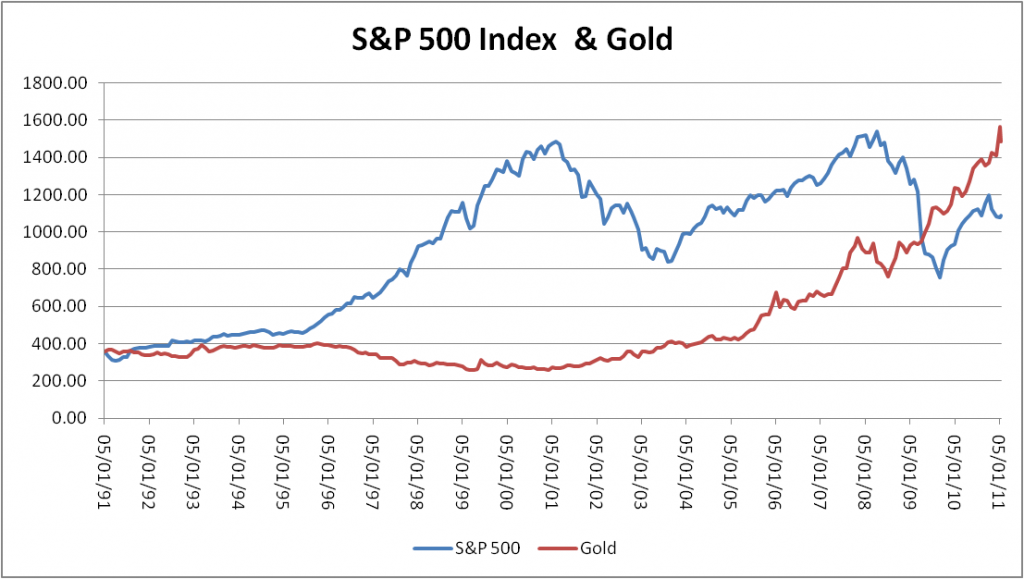

Gold vs S&P500

If you compare the historical charts of Gold and stock index (e.g. S&P500) you will notice that S&P index has shown much better results and opportunities for investors. I would say Gold is more like a Fixed deposit or a GIC or a long term bond but you need to be thoughtful of the form of investment. Just like the metal when sold or bought by the goldsmith will loose some value in the form of labor or fee, same is for trading (funds or commodities or ETFs). Do not ignore the fee you pay for the lockers and safes to store the metal. Basically take all the costs in to consideration and then access the value of the asset.

For a person who is not financially educated in terms of investment or stocks, keeping metal is a simplest form. Our Grandparents have done it and it has been as simple as storing the jewelry in a safe place and its value getting appreciated. But if you are reading this article I am sure you have investment knowledge and will rather focus on diversified options of trading.

The new generations staying in condos and rarely going to banks and accessing everything online have a different mindset of investment. I would agree with the fact that investing in stocks is a better judgement and stocks are also as liquid as a metal in safe.

So if you are planning to invest in gold, think twice and do not use it more than diversifying your portfolio. Artificial jewelry looks as good as gold and can be bought with variety of designs to suit your attire. The opinion is my personal, I have no intention to generate fights in your family ! Be considerate and invest wisely.

Author: Gagandeep Singh

Awesome advise. As usual your articles are of great value for beginners and experienced alike.